As the UAE continues its journey toward economic diversification and transparency, the business audit landscape is rapidly evolving. Staying up-to-date with the latest trends and regulatory changes is essential for companies looking to remain compliant and competitive. In this blog, we’ll explore some of the key trends and regulatory shifts in the UAE’s business audit scene for 2024.

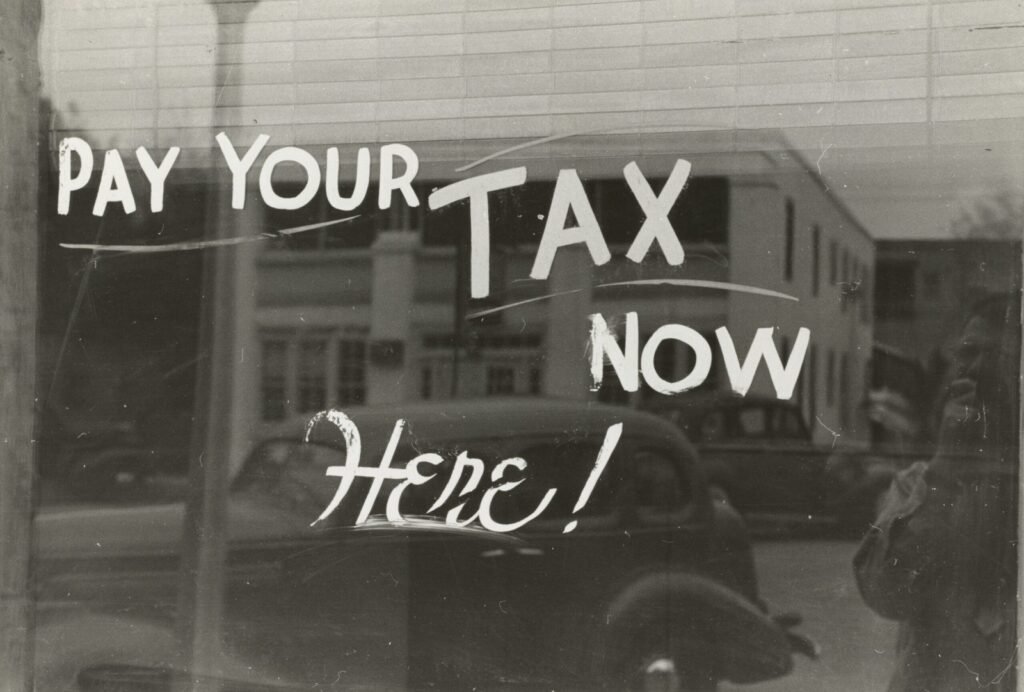

1. Introduction of the Corporate Tax and Its Impact on Audits

The UAE’s recent corporate tax implementation, set at 9% on taxable profits exceeding AED 375,000, has brought significant attention to compliance and tax auditing. Businesses now face new audit requirements to ensure tax accuracy and timely filing, especially with penalties introduced for late or inaccurate submissions.

- Impact on SMEs and Corporates: SMEs and large enterprises alike are required to undergo thorough financial audits to meet corporate tax obligations, emphasizing accurate bookkeeping, financial reporting, and tax planning.

2. Increased Focus on Environmental, Social, and Governance (ESG) Audits

As part of global efforts toward sustainability, UAE businesses are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their operations. There is a growing demand for ESG audits that assess corporate social responsibility, environmental impact, and ethical governance standards.

- Key Considerations: UAE authorities are encouraging sustainable practices, with some free zones offering benefits to environmentally conscious companies. Audits that address ESG factors can help companies stand out and comply with the nation’s sustainability goals.

3. Enhanced Regulations on Anti-Money Laundering (AML) and Financial Compliance

The UAE’s commitment to combatting financial crime continues to strengthen, with updated AML regulations impacting business audits. The Ministry of Economy (MoE) and Central Bank have intensified requirements for businesses in high-risk sectors, such as real estate and financial services.

- Audit Implications: Auditors now need to ensure businesses follow stricter KYC (Know Your Customer) protocols, transaction monitoring, and reporting standards to avoid regulatory sanctions.

4. Adoption of Advanced Technology in Auditing

Technological advancements are reshaping the auditing process in the UAE, particularly with the adoption of AI and data analytics. These tools provide deeper insights and streamline audit processes, making compliance more efficient and effective.

- The Role of AI and Automation: Many firms are now using AI-powered tools for fraud detection, real-time data analysis, and error identification. This trend not only speeds up audits but also improves accuracy and reduces the chances of human error.

5. IFRS Standards and Their Implications for UAE Businesses

The International Financial Reporting Standards (IFRS) have become increasingly relevant for UAE businesses as more sectors adopt these global reporting standards. Aligning financial reports with IFRS is crucial for companies looking to attract international investors and enhance transparency.

- Impact on Audits: With these standards, auditors play a critical role in helping businesses transition and align their financial reporting, especially for companies expanding globally or collaborating with international partners.

6. Internal Controls and Cybersecurity Audits

As cyber threats rise, cybersecurity audits are becoming essential for companies of all sizes. With an increasing number of businesses adopting digital systems, there is a higher risk of data breaches and cyberattacks, making cybersecurity audits a top priority.

- Why It Matters: Cybersecurity audits can identify vulnerabilities in a company’s IT infrastructure, ensuring sensitive financial data remains protected. This is especially important for finance-intensive sectors such as banking, insurance, and consulting.

Conclusion

With evolving regulations and technological advancements, the UAE’s business audit landscape is adapting to new standards of transparency, compliance, and efficiency. Staying informed on these latest trends will help UAE businesses not only remain compliant but also stay competitive in a rapidly changing market.