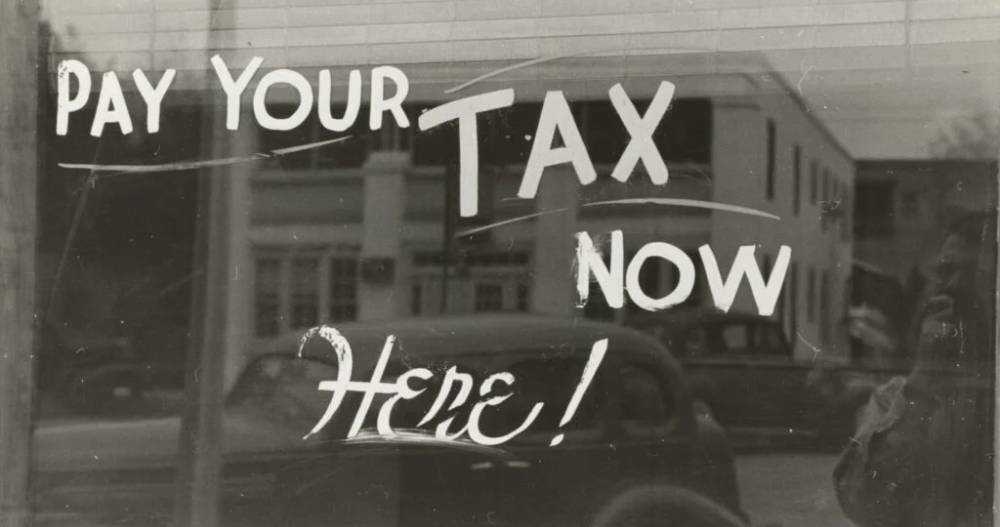

A Guide for VAT Registration in the UAE

The introduction of value-added tax in the UAE has reshaped the business landscape, and companies have to abide by a new set of compliance standards. VAT registration is one of the critical processes for businesses that meet the thresholds required, ensuring compliance with tax regulations and avoiding penalties. This guide provides an all-inclusive overview of […]

Read MoreHow much does an accountant cost in Dubai?

In today’s competitive business environment, maintaining accurate financial records and ensuring compliance with regulations are critical for success. Whether you’re a startup, SME, or multinational corporation, hiring professional Best accounting services in dubai is a strategic investment. But how much does an accountant cost in Dubai, and what factors influence these rates? This blog breaks […]

Read MoreHow to Register for Corporate Tax in the UAE: A Step-by-Step Guide

Corporate tax regulation in the UAE is an established fact; however, with this fact in place, all businesses have to register for it in a timely and correct manner. Therefore, registration is considered one of the most critical regulatory compliance processes, and without it, companies could face a plethora of potential penalties. To understand how […]

Read MoreWhy Every Business in UAE Needs a Corporate Tax Accountant

Indeed, navigating the complexity of tax matters in the UAE is very complex for businesses to handle, not to mention new and developing tax regulations for corporations. Every business in the UAE should consider employing a corporate tax accountant to achieve compliance, maximum tax efficiency, and avoid pricey penalties. And here’s why partnering with professionals […]

Read MoreThe Impact of UAE Corporate Tax on Businesses: Key Considerations

Introduction The introduction of corporate tax in the UAE has become one of the most discussed topics in the business, audit, and tax advisory sectors this year. After years of operating in a tax-free environment, businesses in the UAE are now preparing for a 9% corporate tax on profits. With the new tax policy now […]

Read MoreTop Trends & Changes in UAE Business Audit Landscape (2025)

As the UAE continues its journey toward economic diversification and transparency, the business audit landscape is rapidly evolving. Staying up-to-date with the latest trends and regulatory changes is essential for companies looking to remain compliant and competitive. In this blog, we’ll explore some of the key trends and regulatory shifts in the UAE’s business audit […]

Read MoreWhere can I find the EmaraTax user manuals?

The FTA has published several user manuals covering many topics. Please click on the links for VAT user manuals and Excise Tax user manuals and search for the user manual that you need.

Read MoreCan I sort refunds and payments by date?

The list of refunds for VAT and Excise Tax are organized in EmaraTax by date, with the most recent one on top. You can view the list of transactions including payments under the “transaction history” section of the “My payments” dashboard. As this list is already sorted by date, you can filter the list based […]

Read MoreI received the reset password email containing a temporary password. On clicking the EmaraTax link shared in the email, I was redirected to the EmaraTax login page. What should I do?

Please follow the instructions provided in the reset password email you received. You will need to login to EmaraTax using the temporary password. Once you are logged in, please follow the on-screen instructions to reset your password.

Read MoreHow can I download my tax return from EmaraTax?

Currently, you can only download an acknowledgment for returns submitted in EmaraTax. Once you submit your tax return, you can find the acknowledgement screen from which you can download the acknowledgment. You will also receive an email from the FTA acknowledging your return submission in EmaraTax.

Read More