Introduction

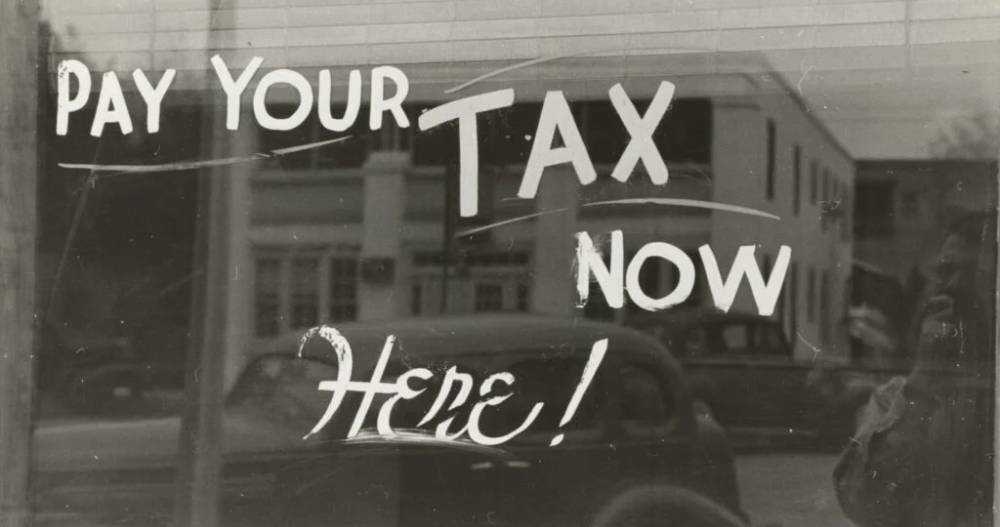

The introduction of corporate tax in the UAE has become one of the most discussed topics in the business, audit, and tax advisory sectors this year. After years of operating in a tax-free environment, businesses in the UAE are now preparing for a 9% corporate tax on profits. With the new tax policy now enforced, understanding the implications for businesses is essential—especially for those relying on audit services in Dubai and across the UAE to ensure compliance and strategic tax planning.

In this blog, we’ll explore the essential aspects of UAE corporate tax, its effects on businesses, and how companies can leverage advisory services to navigate compliance smoothly.

1. What is UAE Corporate Tax?

The UAE introduced corporate tax in 2023 as part of its efforts to diversify the economy and align with global standards. The new law mandates a 9% corporate tax on business profits exceeding AED 375,000, providing an exemption for smaller enterprises and maintaining the UAE’s appeal as a business hub. CPA Auditing is here to present these services.

Key Details:

- Tax rate: 9% on profits exceeding AED 375,000.

- Applicable to all businesses except qualifying free zone entities.

- Certain sectors like agriculture and select government entities are exempt from corporate tax.

For audit and advisory services in Dubai and the UAE, understanding these specifics is crucial, as businesses need expert support to stay compliant with the new tax framework.

2. Why Corporate Tax?

The UAE’s shift toward a corporate tax regime signals its commitment to diversifying its economy. As part of the OECD’s Inclusive Framework, the corporate tax aligns the UAE with global tax standards, helping to build sustainable revenue streams and attract foreign investment. This policy evolution is expected to strengthen the UAE’s fiscal resilience and drive its position as an international business hub.

3. Key Impacts on Businesses

The introduction of corporate tax affects various facets of business operations, requiring adaptation in financial reporting and operational strategies.

- Financial Planning: Companies need to adjust their budgets to include the 9% corporate tax, especially those accustomed to a tax-free environment.

- Compliance and Reporting: Businesses now have additional financial reporting requirements, increasing the demand for audit services in Dubai and other emirates to ensure transparency.

- Profit Reinvestment: While companies may reconsider reinvestment strategies, those with sound financial planning and tax advisory services can identify growth opportunities despite the new tax.

4. Considerations for Auditors and Tax Advisors: Corporate tax

For auditors and tax consultants in the UAE, the corporate tax policy presents unique opportunities. Businesses now rely on advisory and audit services to navigate compliance and implement effective tax strategies.

- Advisory on Compliance: Auditors and advisors guide businesses in establishing tax-compliant practices and record-keeping, especially for companies unfamiliar with taxation.

- Tax Optimization: With strategic planning, tax advisors can help clients identify legal avenues to optimize tax burdens.

- Documentation Support: With increased documentation needs, auditors assist in maintaining organized and accessible records for accurate tax filing.

5. Digital Transformation in Tax Compliance

Corporate tax is accelerating digital transformation in the UAE, with businesses turning to tax and accounting software to automate financial reporting and ensure compliance. Implementing digital tools not only streamlines tax filing but also aligns with the UAE’s vision for modernization. Digital tax solutions allow for efficient preparation, documentation, and data management, essential for companies looking to stay compliant under the new tax regime.

6. Opportunities in the Audit Industry

The UAE’s tax landscape provides growth potential for audit and advisory services. Companies are now more likely to engage audit firms in Dubai and the UAE to ensure compliance, creating opportunities for growth in areas like:

- Tax Audits and Reviews: With the increased need for tax audits, demand for audit services in the UAE is set to rise as companies seek compliance verification.

- Internal Controls: Businesses rely on auditors to ensure internal controls can support accurate tax reporting.

- Strategic Tax Planning: The need for strategic advisory services is increasing as firms look to optimize tax positioning and ensure compliance with UAE tax law.

7. Preparing for Future Changes

As UAE corporate tax regulations may continue to evolve, companies need to remain informed and agile. Staying up to date with tax law developments is essential for businesses and auditors alike, as the UAE government may refine policies to keep the business landscape competitive. In this changing environment, audit services in Dubai and advisory services across the UAE are critical to helping companies understand and adapt to new requirements.

Conclusion

The introduction of corporate tax in the UAE has transformed the business landscape, presenting both challenges and opportunities. By leveraging audit services in Dubai and throughout the UAE, companies can ensure compliance and adapt to this new regulatory environment. For tax advisors and auditors, this shift is a chance to strengthen their roles as trusted advisors, helping businesses navigate compliance and embrace opportunities for growth within the UAE’s evolving economy.

By staying informed and strategically planning, businesses can continue to thrive in the UAE while contributing to the nation’s sustainable growth and diversification vision.