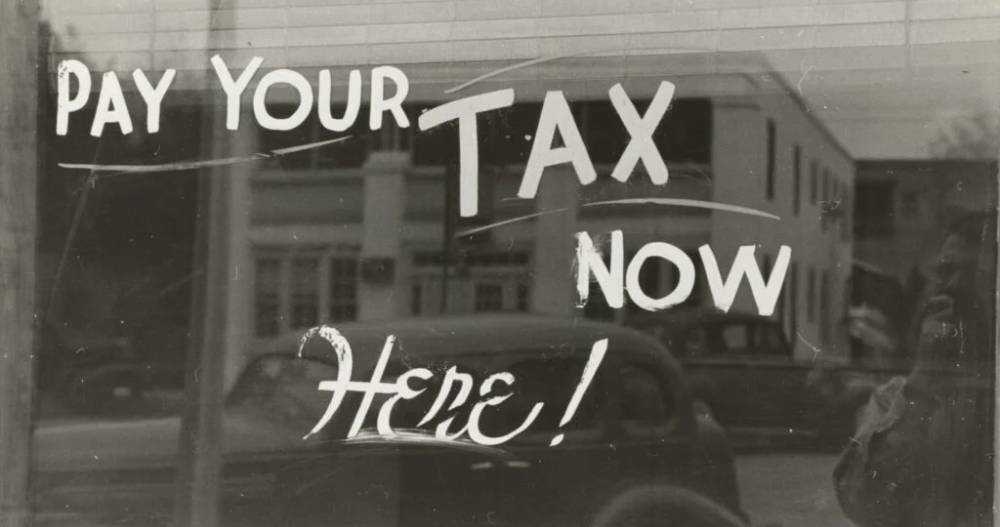

The Impact of UAE Corporate Tax on Businesses: Key Considerations

Introduction The introduction of corporate tax in the UAE has become one of the most discussed topics in the business, audit, and tax advisory sectors this year. After years of operating in a tax-free environment, businesses in the UAE are now preparing for a 9% corporate tax on profits. With the new tax policy now […]

Read MoreTop Trends & Changes in UAE Business Audit Landscape (2025)

As the UAE continues its journey toward economic diversification and transparency, the business audit landscape is rapidly evolving. Staying up-to-date with the latest trends and regulatory changes is essential for companies looking to remain compliant and competitive. In this blog, we’ll explore some of the key trends and regulatory shifts in the UAE’s business audit […]

Read MoreWhere can I find the EmaraTax user manuals?

The FTA has published several user manuals covering many topics. Please click on the links for VAT user manuals and Excise Tax user manuals and search for the user manual that you need.

Read MoreCan I sort refunds and payments by date?

The list of refunds for VAT and Excise Tax are organized in EmaraTax by date, with the most recent one on top. You can view the list of transactions including payments under the “transaction history” section of the “My payments” dashboard. As this list is already sorted by date, you can filter the list based […]

Read MoreI received the reset password email containing a temporary password. On clicking the EmaraTax link shared in the email, I was redirected to the EmaraTax login page. What should I do?

Please follow the instructions provided in the reset password email you received. You will need to login to EmaraTax using the temporary password. Once you are logged in, please follow the on-screen instructions to reset your password.

Read MoreHow can I download my tax return from EmaraTax?

Currently, you can only download an acknowledgment for returns submitted in EmaraTax. Once you submit your tax return, you can find the acknowledgement screen from which you can download the acknowledgment. You will also receive an email from the FTA acknowledging your return submission in EmaraTax.

Read MoreFTA Showcases UAE Tax System at Belt and Road Initiative Tax Administration Cooperation Forum

FTA Showcases UAE Tax System at Belt and Road Initiative Tax Administration Cooperation Forum The Federal Tax Authority (FTA) made a significant impact at the fourth conference of the Belt and Road Initiative Tax Administration Cooperation Forum (BRITACOF) in Tbilisi, Georgia. This three-day event attracted notable international participation and served as a platform for the […]

Read MoreFTA & Umm Al Quwain Chamber Boost Tax Awareness in the UAE

FTA and Umm Al Quwain Chamber Join Forces to Cultivate Tax Awareness In a strategic move to enhance tax awareness and encourage compliance, the Federal Tax Authority (FTA) has entered into a memorandum of understanding (MoU) with the Umm Al Quwain Chamber of Commerce and Industry. This collaboration is geared towards promoting a tax culture […]

Read MoreFTA Boosts Corporate Tax Compliance with New Workshop in Ras Al Khaimah

FTA Boosts Corporate Tax Compliance with New Workshop in Ras Al Khaimah The Federal Tax Authority (FTA) is actively continuing its mission to enhance Corporate Tax awareness across the UAE with a newly organized workshop in Ras Al Khaimah. This event is part of a broader campaign aimed at educating businesses on the general principles […]

Read MoreFTA Enhances SME Support with Corporate Tax Workshop in RAK

Empowering UAE’s Entrepreneurs: Key Takeaways from FTA’s Latest Tax Workshop for SMEs In its relentless pursuit to bolster the understanding and compliance of Corporate Tax laws within the UAE, the Federal Tax Authority (FTA) recently organized a highly engaging workshop specifically tailored for small and medium-sized enterprises (SMEs) in Ras Al Khaimah. This workshop is […]

Read MoreFTA Advances Corporate Tax Knowledge for SMEs with New Workshop in Ras Al Khaimah

FTA Advances Corporate Tax Knowledge for SMEs with New Workshop in Ras Al Khaimah The Federal Tax Authority (FTA) is steadfast in its commitment to enhancing Corporate Tax understanding across the UAE, particularly among small and medium-sized enterprises (SMEs). As part of its ongoing Corporate Tax Awareness Campaign, the FTA recently hosted a focused workshop […]

Read MoreImportant Deadline for Corporate Tax Registration in UAE

FTA Announces Corporate Tax Registration Deadline for Early-Year License Holders The Federal Tax Authority (FTA) has issued a reminder to all resident juridical persons with licenses issued in January and February to submit their Corporate Tax registration applications by the 31st of May 2024. This call to action is crucial to ensure compliance with the […]

Read MoreFTA Advances Corporate Tax Knowledge at Fujairah Workshop

FTA Continues to Educate on Corporate Tax Principles with New Workshop in Fujairah The Federal Tax Authority (FTA) is vigorously continuing its nationwide campaign to enhance understanding of the general principles of Corporate Tax. This initiative is designed to directly engage with various business sectors across the UAE, emphasizing the importance of compliance and the […]

Read MoreFTA Enhances Tax Compliance with Awareness Campaigns

FTA Enhances Tax Awareness with Innovative Campaigns and Programs The Federal Tax Authority (FTA) of the UAE has significantly expanded its educational outreach, introducing a series of innovative campaigns and programs aimed at enhancing tax awareness across various sectors of the business community. This initiative is part of the FTA’s strategic efforts to foster a […]

Read MoreFTA Earns Third ISO 22301 Certification for Business Continuity

FTA Triumphs with Third Consecutive ISO 22301 Certification for Business Continuity The Federal Tax Authority (FTA) of the UAE has once again demonstrated its commitment to operational excellence and resilience by successfully renewing the ISO 22301 Certification for Business Continuity. This marks the third consecutive year the FTA has achieved this standard, underscoring its robust […]

Read MoreFTA Champions Digital Tax Transformation at Beijing Seminar

FTA Showcases Digital Tax Innovations at International Seminar in Beijing The Federal Tax Authority (FTA) of the UAE proudly participated in the prestigious ‘Digitalisation and Digital Transformation of Tax Administrations’ seminar held in Beijing, China. This event marked a significant milestone in showcasing the UAE’s leadership in digital tax administration on a global platform. Leading […]

Read MoreEmbracing Sustainability: The Rise of Green Buildings in Urban Landscapes

Embracing Sustainability: The Rise of Green Buildings in Urban Landscapes As cities around the world continue to expand, the importance of sustainability in architecture has never been more pronounced. Green buildings, which prioritize environmental responsibility and resource efficiency, are quickly becoming a cornerstone of urban development. This shift not only supports ecological preservation but also […]

Read MoreFTA’s Reverse Charge Mechanism for Electronic Devices

Navigating New VAT Regulations: FTA Introduces Reverse Charge Mechanism for Electronics The Federal Tax Authority (FTA) has officially announced the implementation of the Reverse Charge Mechanism (RCM) for electronic devices among VAT registrants in the UAE, effective from October 30, 2023. This significant update is poised to impact the way VAT is handled within the […]

Read MoreFTA Announces Reverse Charge for Electronic Devices

FTA Clarifies Reverse Charge Mechanism for Electronic Devices in the UAE The Federal Tax Authority (FTA) has recently issued a public clarification regarding the implementation of the Reverse Charge Mechanism (RCM) on electronic devices among VAT registrants in the UAE, set to take effect from October 30, 2023. Understanding the Reverse Charge Mechanism Starting this […]

Read MoreFTA’s Proactive Approach: Enhancing Tax Services Through Stakeholder Engagement

FTA’s Proactive Approach: Enhancing Tax Services Through Stakeholder Engagement The Federal Tax Authority (FTA) is taking significant strides to refine its tax services by actively seeking input from various business sectors, aligning with the UAE’s ambitious ‘Zero Government Bureaucracy Programme’. Fostering a Collaborative Environment for Tax Innovation In a recent initiative, the FTA hosted a […]

Read More