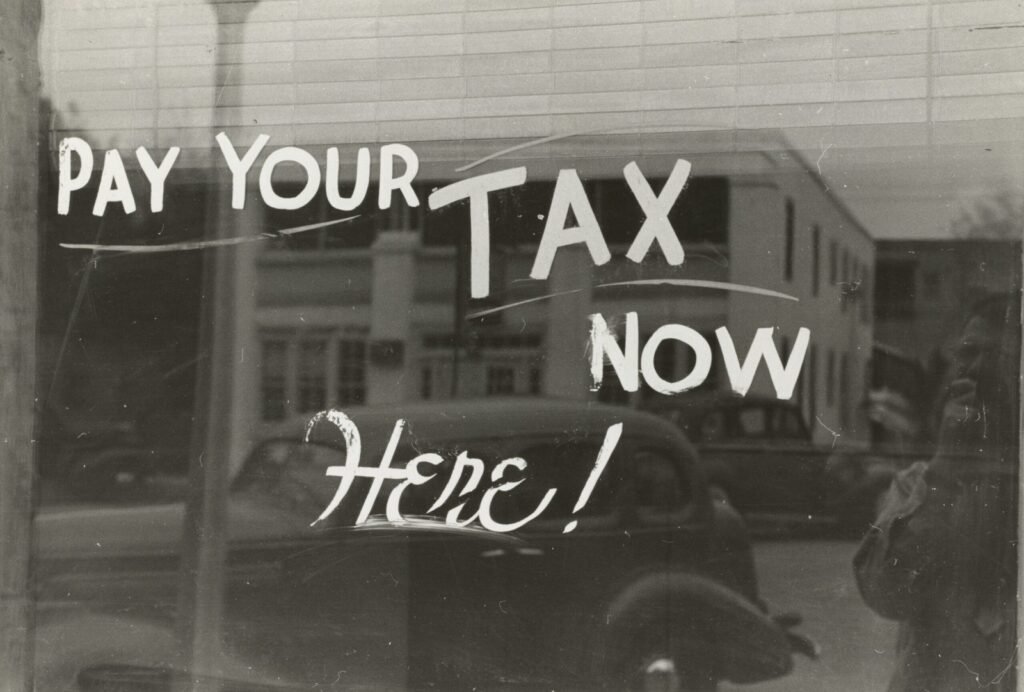

The Impact of UAE Corporate Tax on Businesses: Key Considerations

Introduction The introduction of corporate tax in the UAE has become one of the most discussed topics in the business, audit, and tax advisory sectors this year. After years of operating in a tax-free environment, businesses in the UAE are now preparing for a 9% corporate tax on profits. With the new tax policy now […]

Read MoreTop Trends and Regulatory Changes in the UAE Business Audit Landscape: A 2024 Perspective

As the UAE continues its journey toward economic diversification and transparency, the business audit landscape is rapidly evolving. Staying up-to-date with the latest trends and regulatory changes is essential for companies looking to remain compliant and competitive. In this blog, we’ll explore some of the key trends and regulatory shifts in the UAE’s business audit […]

Read MoreWhere can I find the EmaraTax user manuals?

The FTA has published several user manuals covering many topics. Please click on the links for VAT user manuals and Excise Tax user manuals and search for the user manual that you need.

Read MoreCan I sort refunds and payments by date?

The list of refunds for VAT and Excise Tax are organized in EmaraTax by date, with the most recent one on top. You can view the list of transactions including payments under the “transaction history” section of the “My payments” dashboard. As this list is already sorted by date, you can filter the list based […]

Read MoreI received the reset password email containing a temporary password. On clicking the EmaraTax link shared in the email, I was redirected to the EmaraTax login page. What should I do?

Please follow the instructions provided in the reset password email you received. You will need to login to EmaraTax using the temporary password. Once you are logged in, please follow the on-screen instructions to reset your password.

Read MoreHow can I download my tax return from EmaraTax?

Currently, you can only download an acknowledgment for returns submitted in EmaraTax. Once you submit your tax return, you can find the acknowledgement screen from which you can download the acknowledgment. You will also receive an email from the FTA acknowledging your return submission in EmaraTax.

Read MoreFTA Showcases UAE Tax System at Belt and Road Initiative Tax Administration Cooperation Forum

FTA Showcases UAE Tax System at Belt and Road Initiative Tax Administration Cooperation Forum The Federal Tax Authority (FTA) made a significant impact at the fourth conference of the Belt and Road Initiative Tax Administration Cooperation Forum (BRITACOF) in Tbilisi, Georgia. This three-day event attracted notable international participation and served as a platform for the […]

Read MoreFTA and Umm Al Quwain Chamber Join Forces to Cultivate Tax Awareness

FTA and Umm Al Quwain Chamber Join Forces to Cultivate Tax Awareness In a strategic move to enhance tax awareness and encourage compliance, the Federal Tax Authority (FTA) has entered into a memorandum of understanding (MoU) with the Umm Al Quwain Chamber of Commerce and Industry. This collaboration is geared towards promoting a tax culture […]

Read MoreFTA Boosts Corporate Tax Compliance with New Workshop in Ras Al Khaimah

FTA Boosts Corporate Tax Compliance with New Workshop in Ras Al Khaimah The Federal Tax Authority (FTA) is actively continuing its mission to enhance Corporate Tax awareness across the UAE with a newly organized workshop in Ras Al Khaimah. This event is part of a broader campaign aimed at educating businesses on the general principles […]

Read MoreEmpowering UAE’s Entrepreneurs: Key Takeaways from FTA’s Latest Tax Workshop for SMEs

Empowering UAE’s Entrepreneurs: Key Takeaways from FTA’s Latest Tax Workshop for SMEs In its relentless pursuit to bolster the understanding and compliance of Corporate Tax laws within the UAE, the Federal Tax Authority (FTA) recently organized a highly engaging workshop specifically tailored for small and medium-sized enterprises (SMEs) in Ras Al Khaimah. This workshop is […]

Read More